Key Points:

- WTI crude stabilises near $67 after two-day drop

- China’s better-than-expected Q2 GDP and US driving demand lift sentiment

- OPEC+ sees stronger oil demand in H2 2025

- Surprise 19.1M-barrel surge in US crude stockpiles weighs

After tumbling more than 3% earlier in the week, oil prices staged a mild comeback on Wednesday, with WTI crude hovering just under $67 per barrel. While still deep in the red on the week, the bounce offered traders a brief reprieve from the pressure that’s dominated July’s trading sessions.

Optimism around seasonal demand in the US and signs of resilience from China’s economy provided the floor—albeit a shaky one.

The recovery followed fresh data showing an uptick in US gasoline consumption, tied largely to robust summer travel activity. That domestic demand bump, paired with China’s second-quarter GDP growth topping expectations, helped ease concerns that the world’s two largest consumers were turning sour on energy.

Markets responded with tentative buying, pulling WTI up from lows of $66.21, but the gains lacked momentum—particularly as traders turned wary ahead of more inventory data and global macro catalysts.

Technical Reversal or Dead Cat Bounce?

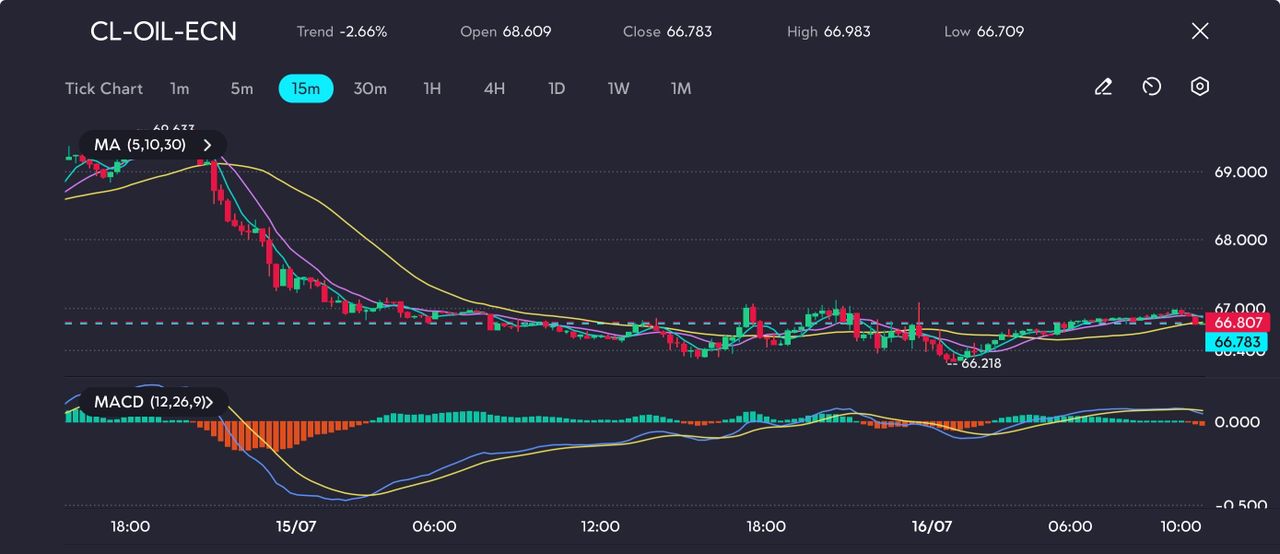

Crude oil is still recovering from a sharp drop from above 69 to the 66.20s, driven by renewed global growth fears and a stronger dollar. The chart shows a prolonged downtrend culminating in a low at 66.218 before buyers cautiously stepped in.

Picture: Oil struggles to bounce after tumbling nearly 3%, pressured by weak China data and rising US stockpiles, as seen on the VT Markets app

The MACD is flattening out just below the zero line, hinting at a possible shift in momentum, though it’s yet to confirm a bullish crossover. The moving averages are converging, which signals that the worst of the selloff might be over—for now.

Still, upside remains capped by resistance at the 67.00 psychological level and again at the 67.60 handle. Bulls will need to reclaim those to establish any meaningful recovery.

Macro Optimism Meets Inventory Reality

Fundamentally, the bullish case isn’t without merit. The OPEC+ monthly report painted a more constructive outlook for the second half of 2025, with stronger growth forecasts for India, Brazil, and China driving higher demand expectations. This came alongside the usual suspects of US and EU recovery themes, adding weight to the “demand will catch up” narrative.

China, in particular, delivered an upside surprise. Despite persistent concerns around tariffs and structural slowdown, the world’s second-largest economy managed to beat growth forecasts in Q2. This helped alleviate pressure on the oil complex, especially after weeks of shaky sentiment tied to weak import data.

However, not all the headlines favoured the bulls. The American Petroleum Institute (API) released a shocker—a 19.1 million-barrel build in crude inventories, marking the largest weekly jump in recorded history.

This came as a gut punch to those expecting further draws amid peak US driving season. Supply, it seems, is still outpacing demand in the short term, and the market is struggling to price in both the long-term optimism and near-term glut

Eyes on Trump’s Ultimatum

Global unrest also played their hand this week. A drone strike in Iraq temporarily shut down production at the Sarsang field, introducing a modest risk premium back into the equation.

Yet fears of a broader disruption were quickly diluted by news that President Trump issued a 50-day ultimatum to Russia rather than escalating immediate sanctions. The move effectively took some heat off the Russian supply side—at least for now.

The result? A conflicted market, caught between bullish long-term projections and bearish short-term fundamentals. WTI remains fragile and highly reactive to incoming data, with each headline swinging sentiment from one extreme to the other.

Unless a clear technical breakout or major cross-border flare emerges, traders may be looking at range-bound action heading into the weekend.