After surging past $3,000 on record ETF inflows, Ethereum enters the week exposed to two high-stakes forces: inflation data and Washington’s long-awaited stance on crypto.

At the centre of this breakout is BlackRock’s iShares Ethereum Trust (ETHA), which posted a record $300 million in inflows last Thursday—its largest single-day intake to date. This pushed ETHA’s assets under management to $5.6 billion, reinforcing its position as the dominant spot Ethereum ETF in the US. In total, Ethereum-focused ETFs attracted roughly $703 million last week, marking their third-largest weekly inflow since launch.

Momentum has been building for weeks. ETHA’s 30-day average trading volume has climbed to 18.83 million shares, a sharp rise from around 13 million in early June. Last Wednesday alone saw 43 million ETHA shares change hands: the most active day since the ETF’s debut a year ago. These aren’t just short-term speculators rotating capital. Since early June, ETHA has seen over $1.2 billion in net inflows, including $159 million last Tuesday alone, the largest single-day inflow since June 11.

Options Traders Double Down on the Upside

The options market tells the same story. Bullish bets dominate, with call options significantly outpacing puts across multiple expiry dates. Open interest in ETHA options has hit its highest level in a year, pointing to strong expectations for more upside. For the 18 July expiry, traders are concentrated around the $22 strike (roughly $3,000 ETH), with growing interest at $23 and $24. These higher strikes suggest that traders aren’t just betting on Ethereum holding its ground—they’re positioning for acceleration toward $3,200.

This sentiment carries through to later expiries. For 25 July, calls at $23 and $24 strikes remain dominant, while lighter open interest at $25 and $26 shows that some are eyeing a move to $3,300. The trend continues through 1 August and 8 August, with call-heavy positioning up to $26, and minimal protection on the downside. That’s a clear signal that most traders see ETH holding above $3,000, with the door open to further gains if momentum continues

Crypto Week in Washington Changes the Game

But this isn’t happening in a vacuum. Ethereum’s rally coincides with a pivotal week in Washington. Lawmakers have kicked off what’s being dubbed “Crypto Week”—a series of debates around three major bills that could reshape the regulatory framework for digital assets in the US.

The Digital Asset Market Clarity Act aims to draw a clear line between securities and commodities, giving the CFTC control over crypto trading and offering exemptions for mature decentralised networks. The industry has long pushed for this kind of clarity, and progress here could finally loosen the regulatory gridlock.

More immediate is the GENIUS Act, which sets the first real framework for stablecoins. With bipartisan support and Senate approval already in hand, the bill mandates 1:1 reserve backing, licensing, and monthly disclosures. It brings stablecoin issuers under Bank Secrecy Act compliance—a huge step toward legitimising digital dollars. President Trump has pledged to sign the bill, giving it even more traction. Stablecoins are the backbone of crypto liquidity, and clarity here may unlock more institutional flows into assets like Ethereum.

Meanwhile, the Anti-CBDC Surveillance State Act aims to block the US Federal Reserve from launching a central bank digital currency without Congressional approval. Though politically charged, it plays well with the crypto crowd and signals a legislative tilt toward open networks rather than centralised digital control.

These developments aren’t just speculative tailwinds. They offer a potential legal foundation for the next phase of crypto adoption. Even if all three bills don’t pass immediately, their progression alone is shifting sentiment—and the market is clearly responding.

Momentum Is Strong, but Risks Still Linger

Still, traders should be careful. Citi analysts have warned that digital assets are still a long way from earning comparisons to traditional safe-haven assets like gold. The pace of Ethereum’s move, while underpinned by strong inflows, raises the risk of short-term exhaustion or profit-taking—especially from traders sitting on leveraged long positions or deep-in-the-money options.

For now, Ethereum’s rally rests on more than hype. Real capital is moving. Regulatory winds are shifting. And traders, both retail and institutional, are reacting accordingly. So long as ETF flows continue and US legislation maintains its course, Ethereum’s recovery looks grounded—though volatility is never far from the surface in crypto.

Key Movements of the Week

Traders are watching carefully for confirmation moves as the US dollar attempts to reclaim momentum and macro forces like inflation and tariffs linger in the background.

The US dollar index (USDX) is slowly grinding higher, but it’s approaching a key test. Price action near the 97.70 zone may act as a turning point. If USD strength pushes beyond that level, bears are eyeing the next resistance around 98.10. A breakout here could reshape short-term expectations for FX pairs, especially if Tuesday’s US CPI surprises to the upside.

EURUSD is drifting lower, with traders now watching for signs of bullish reversal at 1.1660 or 1.1605. These levels represent key structure zones, and a CPI beat could keep the euro on the defensive. However, any softness in inflation could ignite a retracement rally, particularly if European sentiment stabilises.

GBPUSD has entered a slower consolidation phase. With UK CPI due Wednesday, bulls are looking for a bounce near 1.3415. That zone could offer a tactical long setup if inflation surprises are mild. But if broader USD strength continues, any upside may remain capped under 1.3535–1.3570 resistance.

USDJPY has already rejected from the 147.75 zone and is now consolidating. If the pair breaks higher on fresh inflation momentum, 148.05 becomes the next upside magnet. However, traders should be cautious—any rejection near these levels could signal a short-term top.

USDCHF continues to inch upward, heading toward 0.8050. With little data from Switzerland this week, USD direction will likely dictate where this pair goes next. Traders should watch closely how price behaves once it reaches that resistance.

In the commodity currencies, AUDUSD is holding above its consolidation zone. If price remains stable around 0.6550, bulls may step in ahead of Thursday’s Australian jobs report. A move higher would put 0.6665 back on the radar. Similarly, NZDUSD has traded down from the 0.6050 level and may print a new swing low before finding support. Watch for base-building before considering long positions.

USDCAD is testing the 1.3715 resistance area. If price breaks through with conviction—especially post-CPI—it could quickly move to test the 1.37587 high. The tug-of-war between Canadian inflation and US macro signals will be central here.

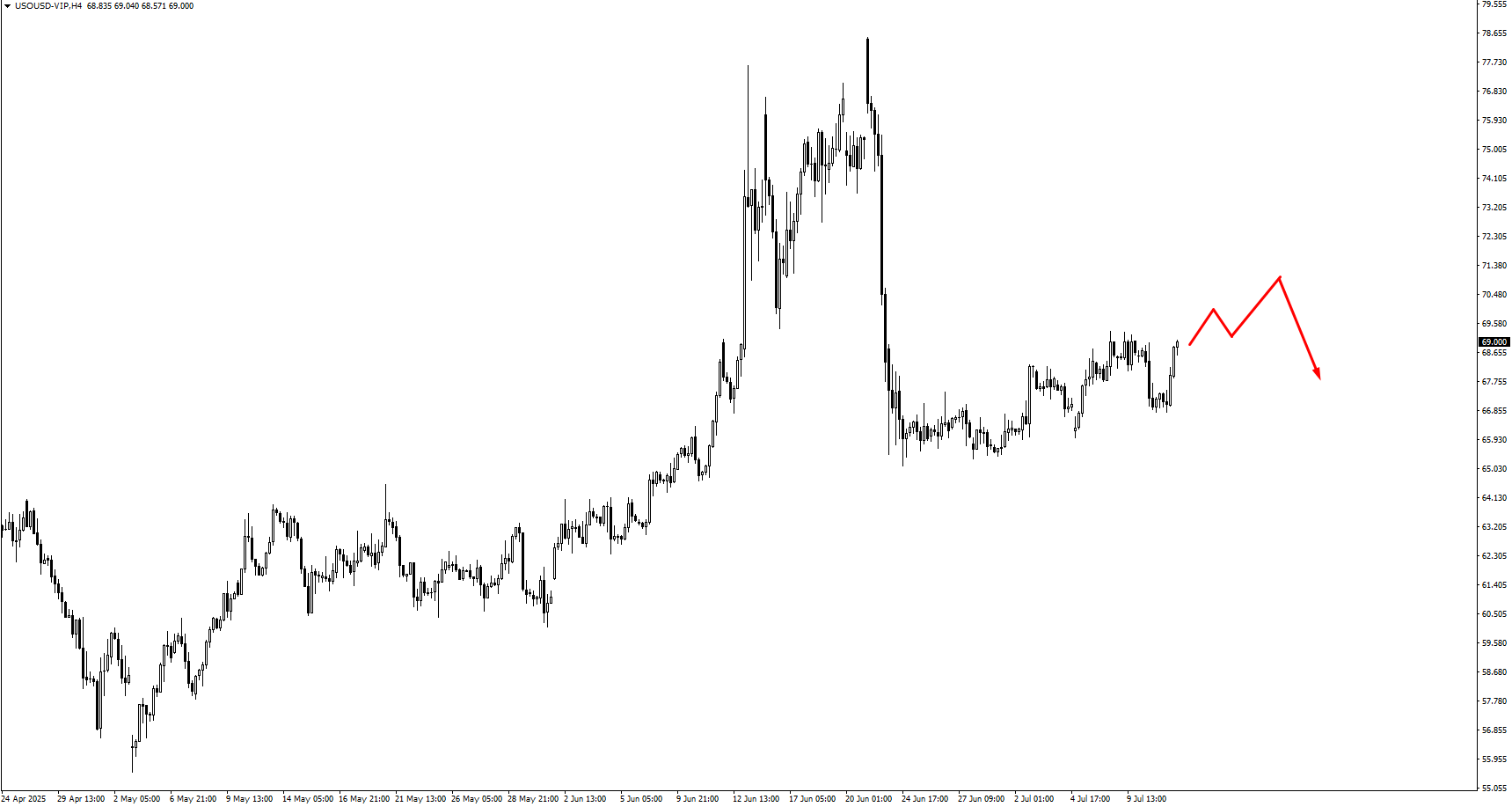

Commodities remain on a knife’s edge. USOIL has rallied slightly but faces resistance at 71.80 and 73.40. These zones are likely to draw selling interest unless supply-side headlines extend the bounce. On the downside, 63.35 and 61.00 remain key supports to watch for reversal setups.

Gold has finally broken above its trendline, suggesting bullish momentum is beginning to return. If prices consolidate cleanly above the breakout zone, bulls will likely aim for 3340 next. However, any renewed dollar strength could limit upside, especially as traders reassess inflation and rate cut timelines in the US.

The SP500 is walking a tightrope. Trump’s renewed tariff threats against Mexico and Europe are clouding what was a strong trend higher. Price has support around 6230, with deeper downside capped at 6170. If bulls recover control, 6400 and 6630 are the next upside levels to monitor.

Bitcoin is back on the rise after a shallow consolidation. Price is approaching the 122,100 to 124,720 zone—a key area where profit-taking could occur. Still, momentum remains constructive, and the broader crypto environment continues to benefit from ETF flows and the regulatory optimism spilling over from Ethereum.

Natural Gas (NG) is still dancing around the 3.35 zone. If it pushes higher, 3.40 is the next resistance level to watch. Volatility remains high here as seasonal shifts and supply dynamics continue to affect trader sentiment.

This week’s price action is less about chasing breakouts and more about timing entries at known technical zones. Many major pairs are sitting near decision points. Patience—and precision—will be key as traders wait for the next macro catalyst to tip the scales.

Key Events of the Week

After a relatively quiet start to the month, this week swings the spotlight back onto macro data. Traders won’t have to guess where market sentiment might shift next with the calendar loaded with reports that could redefine interest rate expectations across major currencies.

All eyes are first on Tuesday, 15 July, where both Canada and the United States drop their latest inflation readings. For Canada, the CPI y/y is forecast at 3.60%, down from the previous 3.85%. A softer print could reignite dovish bets for the Bank of Canada, particularly if USD strength persists. However, the crosscurrents from ongoing US tariff issues may muddy CAD’s reaction, especially if broader risk appetite begins to falter.

The US print could steal the show. Headline CPI y/y is forecast to rise to 2.60%, up from 2.40%. This is not the direction markets nor the Trump administration want to see. A hotter inflation number here could stall any discussion of near-term rate cuts from the Fed. The result? A stronger dollar and potentially sharp downside in risk-sensitive FX pairs like AUDUSD and NZDUSD. Even equities may pause if markets begin re-pricing the Fed’s glidepath.

On Wednesday, 16 July, the UK delivers its CPI data, forecast flat at 3.40% y/y. With no change expected, the report may take a back seat unless there’s a surprise. But traders should still watch price action around this release, as GBPUSD sits near key resistance and could break either way on deviation.

Thursday, 17 July, kicks off with Australia’s Employment Change report, where the forecast stands at +21.0K, a rebound from last month’s -2.5K. If AUDUSD is truly building a base—as recent price action suggests—this report could provide the fuel for a breakout toward 0.6665. Strong numbers here would also help anchor RBA rate expectations and calm recent concerns about domestic demand.

Later that day, the US Retail Sales m/m lands, with a forecast of 0.20%, following last month’s -0.90%. A bounce here would paint a picture of improving consumer strength—giving the Fed even more reason to delay any easing cycle. Traders should watch how the USD behaves into this print. If the number beats expectations, we could see US yields firm up again, putting pressure on gold, AUD, and equities.